|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Place to Refinance Home Loan: Comprehensive Guide for HomeownersRefinancing your home loan can be a wise financial move, allowing you to take advantage of lower interest rates or change the terms of your mortgage. However, finding the best place to refinance your home loan requires careful consideration. This guide provides insights into how to choose the right lender and maximize the benefits of refinancing. Understanding RefinancingRefinancing involves replacing your existing mortgage with a new one, usually with better terms. It's crucial to understand the different types of refinancing available and which is best suited for your needs. Types of Refinancing

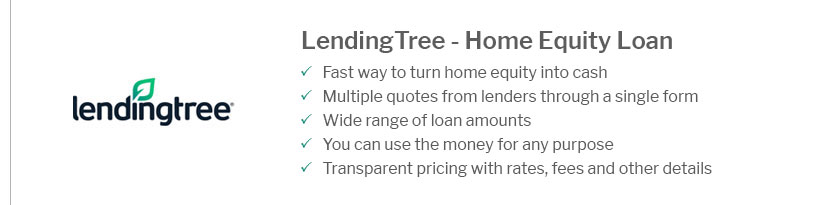

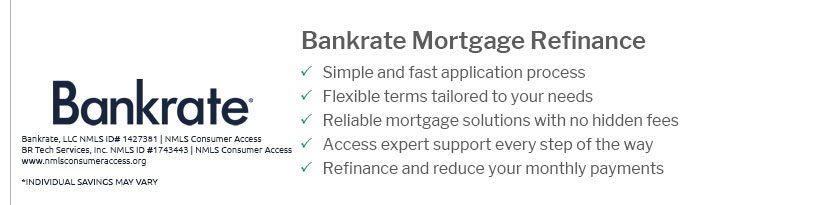

Choosing the Right LenderFinding the best place to refinance involves comparing various lenders, their offers, and terms. Consider these factors: Interest Rates and FeesLook for lenders offering the lowest interest refinance rates. Also, be mindful of associated fees, which can significantly impact the overall cost of refinancing. Customer Service and ReputationA lender with a solid reputation and excellent customer service can make the refinancing process smoother and more reassuring. No-Cost Refinance OptionsSome lenders offer no cost refinance options, where they cover closing costs in exchange for a slightly higher interest rate. This can be beneficial if you plan to stay in your home for a shorter period. Steps to Refinance

FAQWhat is the best time to refinance my home loan?The best time to refinance is when interest rates are lower than your current rate, your credit score has improved, or you want to switch from an adjustable-rate mortgage to a fixed-rate mortgage. How do I know if refinancing is right for me?Consider your financial goals, current mortgage terms, and how long you plan to stay in your home. A break-even analysis can help determine if the cost savings justify the refinancing costs. Can I refinance with bad credit?While it's more challenging, some lenders specialize in refinancing for individuals with less-than-perfect credit. You may face higher interest rates and fees. https://www.youtube.com/watch?v=MkN5QC4FPKk

Just because Interest Rates Are Lower Doesn't Mean That You Should Refinance Your Mortgage. In this video, I discuss what you have to ... https://www.businessinsider.com/personal-finance/mortgages/when-to-refinance-mortgage

Average refinance closing costs vary depending on where you're located, your mortgage lender, and the type of loan you're getting, but generally ... https://www.pennymac.com/refinancing

great starting point for determining what types of refinance loans will work for you.

|

|---|